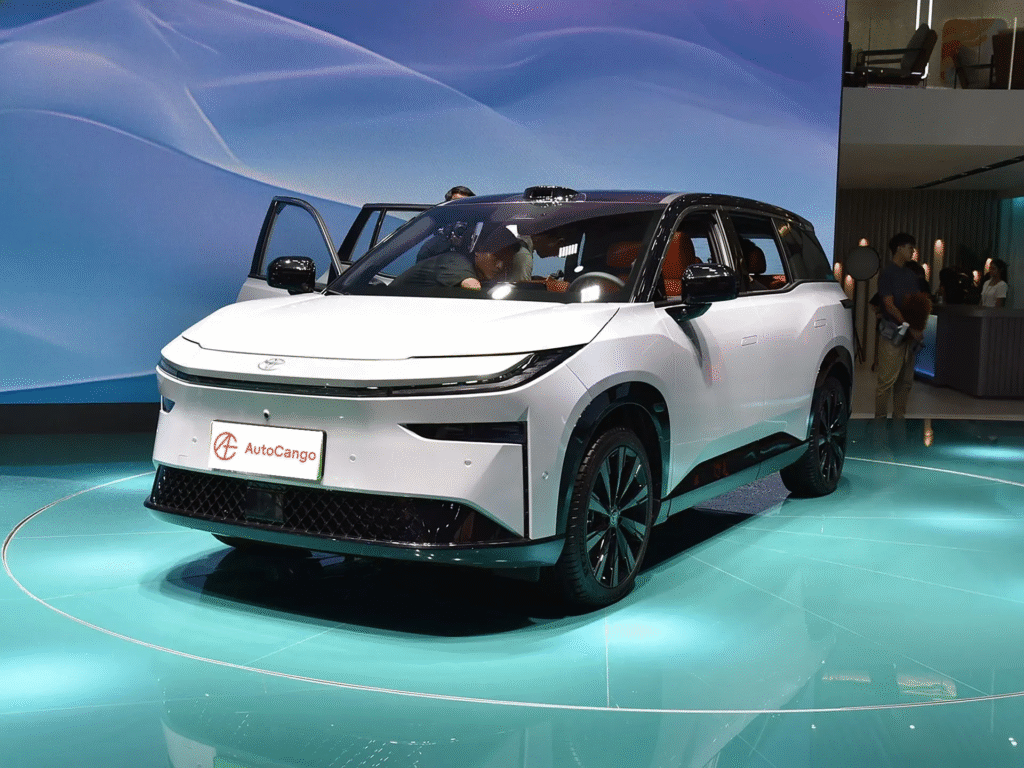

Toyota’s newly launched bZ3X electric SUV is off to a flying start in China, quickly becoming the best-selling electric vehicle (EV) in the country for May 2025. Launched in March through Toyota’s joint venture with GAC (GAC Toyota), the bZ3X is priced from just 109,800 yuan (approximately $15,000), making it Toyota’s most affordable EV to date in China.

In May alone, the bZ3X sold 4,344 units, surpassing competitors like the Volkswagen ID.3 and Nissan’s N7. By the end of April, over 10,000 units had already been delivered, with 12,000 more pending orders — a remarkable feat for a vehicle that had only just entered the market.

Several factors explain why Toyota chose such an aggressive price point. The company has historically lagged in the EV space, especially in China’s highly competitive and fast-moving market. By pricing the bZ3X so affordably, Toyota is not only trying to catch up but to make a bold statement.

Local production through its GAC partnership helped keep manufacturing costs down, allowing the company to offer high-end specs without the premium price.

Additionally, Toyota was responding to Chinese consumer demands for affordable EVs that still offer long range, advanced safety tech, and comfort — all areas where the bZ3X delivers.

What made the bZ3X such a hit wasn’t just the price. Buyers are getting tremendous value: a full-size electric SUV available in seven trims, including two variants equipped with LiDAR, making Toyota the first joint venture brand in China to offer this technology. The SUV also comes with two battery options: 50.03 kWh for 430 km of range and 67.92 kWh for up to 610 km (CLTC).

The interior design is another major selling point, featuring a clean, modern layout with a 12.3-inch infotainment display and an 8.8-inch digital instrument cluster, plus nearly 10 feet of flat space when the seats are folded down. Toyota calls it a “mobile space as comfortable as home.”

In terms of smart features, the bZ3X uses Momenta’s 5.0 smart driving system, offering Level 2 autonomous driving, remote parking, and more. These enhancements, typically reserved for more expensive models, give the bZ3X a significant edge in the sub-$20,000 EV category.

With the high-tech features, long range, and attractive price, the bZ3X found favor not just with Toyota loyalists but with young tech-savvy buyers looking for a budget-friendly yet premium experience.

Ultimately, the success of the bZ3X highlights Toyota’s strategic shift to meet Chinese consumer expectations head-on. With rising competition from homegrown EV giants like BYD and NIO, Toyota needed a product that could redefine its image in China.

The bZ3X appears to be doing just that — combining the brand’s global reputation for reliability with locally developed innovations and pricing that feels almost too good to be true.

This is not just a rebound — it’s a blueprint for how foreign automakers can thrive in China’s evolving electric vehicle market.